Esta web utiliza cookies para que podamos ofrecerte la mejor experiencia de usuario posible. La información de las cookies se almacena en tu navegador y realiza funciones tales como reconocerte cuando vuelves a nuestra web o ayudar a nuestro equipo a comprender qué secciones de la web encuentras más interesantes y útiles.

Publicaciones

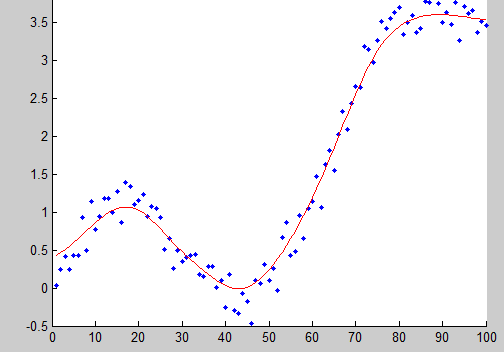

While it has long been recognised that active management is an important issue in the area of mutual fund performance, little consensus has been reached about the value managers’ abilities can add. This study examines funds’ and managers’ characteristics in an attempt to understand their influence on mutual fund efficiency. We explore these issues in a two-stage approach, considering partial frontier estimators (order-m, order-α) to assess performance in the first stage, and quantile regression in the second stage to isolate the determinants of efficiency. This combination of methodologies has barely been considered to date in the field of operations research. Our findings are of interest to both academics and practitioners as they shed light on the differences among funds as well as among managers. Our analysis provides some arguments to guide fund selection and points to some managerial features investors might consider taking into account. In addition, some of the differences in performance among funds are rather intricate because both the magnitude of the estimated regression coefficients and their significance varies depending on the quantile of the distribution of fund performance, suggesting that some relevant trends might be concealed by conditional-mean models such as Tobit or OLS.

Matallín, J.C., A. Soler y E. Tortosa-Ausina (2019). «Does active management add value? New evidence from a quantile regression approach». Journal of the Operational Research Society 70, n.º 10: 1734-1751.